|

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Analysts Think This Drone Stock Can Soar 50% From Here. Should You Buy Its Shares on the Dip?/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

Airo Group (AIRO) quickly impressed investors after delivering a surprise beat in earnings in its last quarter, a key breakthrough by this new drone producer. The shares have been unpredictable since going public on Nasdaq, recently at $20, around half of its 52-week high, although analysts now predict up to 60% of potential upside from here. Growing unmanned aerial systems demand and a new commitment to scaling up production, Airo is becoming a disruptive player in drone-based defense as well as commercial sectors. The broader aerospace and defense market has regained momentum in 2025 as a result of accelerating government expenditure, supply chain diversification, and unmanned technology takeup. Though speculative-defense stocks like Airo have been at the back of the S&P 500's (SPY) steady double-digit rises this year so far, what appears as a good entry spot might be taking shape among investors who are looking towards drones as well as high-end aerospace systems' next period of growth. About AIRO StockAiro Group is a drone and aerospace systems firm based in Reston, Virginia. The company creates, produces, and designs unmanned aerial systems and associated defense products, which it sells to commercial customers as well as government customers. Airo, with a market cap of approximately $552 million, is in the emerging technology space of aerospace and defense. The shares have ranged in a broad 52-week range of $12.90 to $39.07, as is normal in early-stage aerospace firms. The current price of the stock at $20.07 is roughly 50% away from highs yet above lows. The S&P 500 Index ($SPX), by comparison, has grown by about 17% over the past year, further emphasizing the underperformance of AIRO relative to the market.

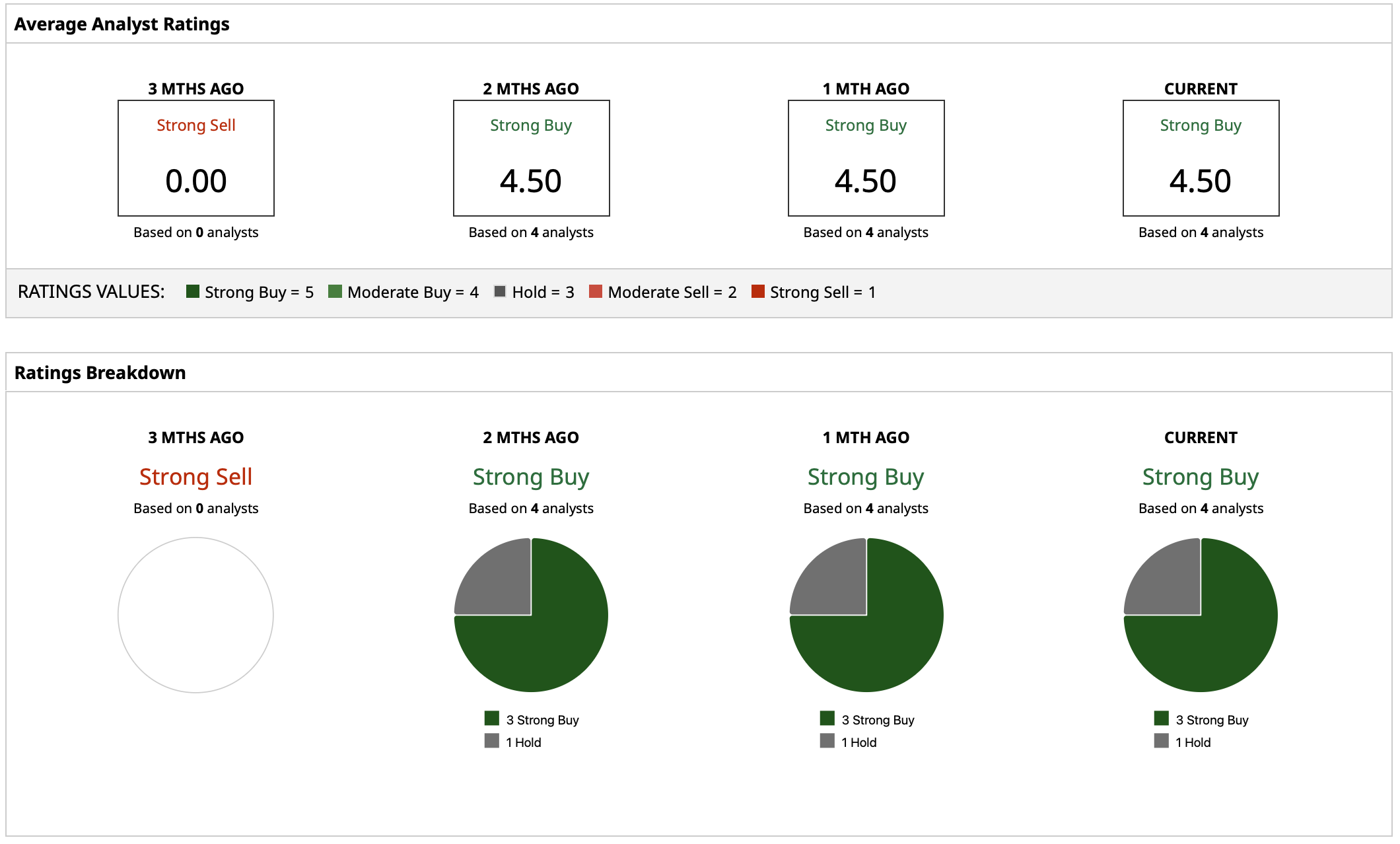

On valuation, Airo's EV/Sales is 5.5 times, rich compared to familiar defense contractors that trade around 2 times, although Airo, as yet, is loss-making, with a trailing 12-month profit margin of -44.5% and no positive earnings ratio. Investors here are paying a premium to unlock potential growth, not earnings. The company has no reported debt, which gives it balance-sheet flexibility as it scales. Airo does not pay dividends, instead focusing its attention on reinvesting in product development, certification, and scale contracts. Airo Group Beats on EarningsDuring its latest period, AIRO generated revenue of $24.55 million and net income of $5.87 million, a dramatic reversal of previous losses. The swing in earnings came as a surprise to investors and triggered a vigorous pre-market pop of nearly 12% in reaction. On a per-share basis, Airo generated earnings of $0.30, above analyst estimates and a good reflection of better execution at the operating level. In the years ahead, management has centered on three imperatives: concluding Blue UAS certification, scaling drone production in the U.S., and expanding relationships across both commercial and defense segments. Those efforts should aid topline acceleration while diversifying streams of revenue away from original contracts. Though the firm has made no specific forward EPS guidance, Airo should remain volatile considering it is in early-stage status. There is no official next-earnings date set for the two-week time frame, so investors should keep an eye out for that announcement. The results of this period were a key proof point that Airo's strategy is gaining traction. Getting back to profitability, at least temporarily, underpins the argument that scaling contracts could create sustainable cash flow earlier than expected. What Do Analysts Expect for AIRO Stock?Coverage by Wall Street analysts of AIRO is limited but supportive, with a “Strong Buy” rating consensus. The current analyst price target of AIRO shares is $30.67, indicating potential gains of about 52% relative to current market prices of about $20. At its Street-high of $35, it works out to about 74% upside, while at its low of $26, it still indicates 29% potential gains.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|